| William E. Carlson | Shapiro Sher Guinot & Sandler |

| Direct Phone 410.385.4205 | 250 West Pratt Street |

| Email: wec@shapirosher.com | Suite 2000 |

| Baltimore, Maryland 21201-3147 | |

| Telephone: 410.385.0202 | |

| Facsimile: 410.539.7611 | |

| shapirosher.com |

May 18, 2016

Anu Dubey, Senior Counsel

Division of Investment Management, Disclosure Review Office

U.S. Securities and Exchange Commission

100 F. Street, NE

Washington, D.C. 20549-5628

| Re: | Princeton Capital Corporation |

Preliminary Proxy Statement

Filed May 4, 2016

Dear Ms. Dubey:

This letter is written in response to oral comments received from the Staff of the Division of Investment Management on May 13, 2016, relating to the Preliminary Proxy Statement (“Preliminary Proxy”) filed on May 4, 2016 on behalf of Princeton Capital Corporation (“Princeton Capital” or “Company”). Attached as Exhibit A to this Correspondence Filing is a redline showing the Preliminary Proxy after the oral comments to the Preliminary Proxy as filed on May 4, 2016. For convenience of reference, the comments of the staff have been reproduced herein in summary form.

| 1. | Please clearly mark on the top of Page 1 of the Preliminary Proxy - “Preliminary Copies.” |

RESPONSE: Page 1 of the Preliminary Proxy has been revised in response to this comment.

| 2. | If legal proceedings are still pending against certain Non-Settling Defendants, please provide additional disclosure if necessary. |

RESPONSE: The disclosure on Page 1 of the proxy statement has been revised in response to this comment to account for litigation that is pending against certain Non-Settling Defendants.

| 3. | Please add Proposal to Adjourn the Annual Meeting when listing the proposals throughout the proxy statement. |

RESPONSE: The proxy statement has been revised throughout in response to this comment.

| 4. | Please revise the 3rd paragraph of Page 3 of the proxy statement to reflect only those votes that were authorized by proxy to do so. |

RESPONSE: The proxy statement has been revised in response to this comment.

| 5. | Please clarify what a “plurality” means on Page 4 of the proxy statement. |

RESPONSE: In response to this comment, a footnote has been added to clarify what the Company means by a “plurality.”

| 6. | Please clarify what “the votes entitled to be cast on the matter” means in Proposals 2-4 on Page 4 of the proxy statement. |

RESPONSE: In response to this comment, a footnote has been added to clarify what the Company means by “the votes entitled to be cast on the matter.”

| 7. | In accordance with Item 407(a)(1)(i) of Regulation S-K, please reference the independence standards of the Company’s interdealer quotation system in addition to the definition under the 1940 Act. |

RESPONSE: As the Company trades on the Over the Counter Pink (“OTCPK”), and the OTCPK does not establish director independence standards, the Company has revised the proxy statement throughout to refer to the independence standards of the NASDAQ Stock Market Rules, as that is the standard that the Company uses in addition to Section 2(a)(19) of the 1940 Act.

| 8. | On Page 6 of the proxy statement, please change “5% Holders” to “Greater than 5% Holders.” |

RESPONSE: The proxy statement has been revised in response to this comment.

| 9. | In accordance with Instruction 4 of Item 401(a) of Regulation S-K, please add language to the 3rd paragraph of Page 8 of the proxy statement, regarding the number of proxies that can be voted when fewer nominees are named for director than the number fixed by the Charter of the Company. |

RESPONSE: The proxy statement has been revised in response to this comment

| 10. | The SEC (under “bundling” rules) views a change in the Charter of a corporation reducing the number of directors, as a separate item that needs to be voted on by stockholders, please review and, if necessary, revise accordingly. |

RESPONSE: The Company does not request that the stockholders vote on the size of the Board (so there is no “bundling” of matters for consideration by the stockholders). Pursuant to the Charter and Bylaws of the Company, the reduction in the number of directors of the Company, is a power that has been delegated to the Board of Directors and not to the stockholders. Pursuant to Resolution of the Board of Directors, the current size of the Company’s Board is six. The Company has clarified that this is not a matter to be voted on by the stockholders and that the Board, if Proposal 2 is approved, will reduce the size of the Board by resolution and the Charter will not be amended to reduce the number of directors.

| 11. | Pursuant to Item 401(e)(1) of Regulation S-K, please include at least the last five years of business experience for each director. |

RESPONSE: The proxy statement has been revised to indicate that the biographies of each of the directors includes their business experience during at least the past five years.

| 12. | Pursuant to Item 401(e)(2) of Regulation S-K, please disclose any other directorships held by each director in the last five years. |

RESPONSE: The proxy statement has been revised to include each of the directors other directorships held in the last five years in response to this comment.

| 13. | Pursuant to Item 401(a) of Regulation S-K, please disclose the length of time each director has served as such. |

RESPONSE: The date each director was appointed to the Board has been added to the proxy statement in response to this comment.

| 14. | In the last sentence of the 3rd paragraph of Page 12 of the proxy statement, please note that the exchange listing standards also apply. |

RESPONSE: The Company revised the proxy statement in response to this comment as set forth in the Company’s response to Comment 7.

| 15. | Pursuant to Item 401(b), please include the last five years of business experience for the Company’s officers and disclose the length of time each officer has served as such. |

RESPONSE: The proxy statement has been revised to indicate that the officer’s biographies include each officer’s business experience during the past five years and the date each officer began serving as such.

| 16. | Please clarify why Mr. Cannella will resign and be re-elected. |

RESPONSE: Mr. Cannella resigning from all positions he holds with the Company and its portfolio companies is a requirement under the Settlement Agreement. However, the Board of Directors (with the consent of the Settling Parties) have since determined that Mr. Cannella is appropriately qualified to remain the Chief Financial Officer of the Company. The proxy statement has been revised in response to this comment.

| 17. | Please indicate the number of times that the Board and each committee of the Board met during 2015. |

RESPONSE: The proxy statement has been revised in response to this comment.

| 18. | Please disclose why the Board feels that it is ok not to have a Compensation Committee when the Company reimburses officer’s expenses and pays the Independent Directors. |

RESPONSE: The Company does not have a compensation committee or a committee performing similar functions because our executive officers do not receive any compensation from the Company. All decisions concerning compensation of Princeton Investment Advisors and Princeton Advisory Group, as applicable, are made by the Board. The Company has chosen not to establish a separately designated compensation committee because the executive officers of the Company do not receive direct compensation from the Company. Executive officers of the Company are employees of, and are compensated by, Princeton Investment Advisors and Princeton Advisory Group, as applicable. Compensation payable by the Company to the Advisor is required to be approved by a majority of the Company’s independent directors pursuant to Section 15(c) of the 1940 Act. Since the Audit Committee consists of a majority of the independent directors of the Company, the Company has allocated responsibility to consider the compensation paid to the Advisor to the Audit Committee. The Nominating and Corporate Governance Committee reviews the form and amount of independent director compensation at least annually and makes any changes, as it deems appropriate. The proxy statement has been revised in response to this comment.

| 19. | Please review the section entitled Compensation of Directors on Page 16 of the proxy statement and (i) please note that Section 63 of the Investment Company Act prohibits closed-end funds from issuing shares for services, and (ii) please disclose to the SEC if shares have ever been issued for services. |

RESPONSE: In response to this comment, the sentence stating that the independent directors have the option of having their directors’ fees paid in shares of common stock has been removed. The Company has confirmed that shares have never been issued for services, including for services as an independent director of the Company.

| 20. | Please review Item 404(a) and Item 404(b) of Regulation S-K and see if additional disclosures need to be made regarding any related party transactions. Please disclose the Company’s Policies and Procedures in related party transactions. |

RESPONSE: The Company has revised the section entitled Certain Relationships and Transactions in response to this comment.

| 21. | Please review Proposal 2 on Page 19 of the proxy statement and, as mentioned in Comment 10, consider whether the Company needs to do any “Unbundling.” |

RESPONSE: The Company has reviewed the comment and the proxy statement with regards to “unbundling,” and as set forth in the response to Comment 10, does not believe that additional Charter amendments are necessary.

| 22. | Please review Item 9(e) of Schedule 14(a) and consider whether the Company should disclose the fees paid to Boulay or Crowe Horwath for the fiscal year ended December 31, 2015. |

RESPONSE: In response to this comment, the Company has revised the proxy statement to include fees paid to Boulay and Crowe Horwath for the fiscal year ended December 31, 2015.

| 23. | Please explain the footnotes on Page 22 of the proxy statement and why there was such a large discrepancy from what was reported in the Definitive Proxy Statement filed on July 13, 2015 and this Preliminary Proxy. |

RESPONSE: The Company’s Chief Financial Officer has indicated that the discrepancy was caused by an oversight of the Company’s management in the draft received from the attorney then representing the Company and that the Definitive Proxy Statement filed on July 13, 2015 contained a typo.

| 24. | Please review Item 22 of Schedule 14(a) and disclose (i) Investment Advisory Fees paid during the last fiscal year, (ii) name and address of the New Investment Advisor, and (iii) the date the Current Investment Advisory Agreement was last submitted to stockholders and the purpose. |

RESPONSE: The Company has revised the proxy statement adding the disclosures required under Item 22 in response to this comment.

| 25. | Pursuant to Item 22(c)(8) of Schedule 14(a), please highlight the material differences between the current investment advisory agreement and the new investment advisory agreement. |

RESPONSE: The Company has added a new section entitled “Material Changes in Investment Advisory Agreement” under Proposal 6 in response to this comment.

| 26. | Please review the 3rd paragraph under the heading “Advisory Services” and the requirement under Section 15(a) that any sub-advisory agreement be approved by the stockholders and revise the proxy statement. |

RESPONSE: In response to this comment, the 3rd paragraph under the heading “Advisory Services” was removed from the proxy statement and the Company has confirmed that this language was not included in the text of the New Investment Advisory Agreement.

| 27. | Please review Item 22(c)(9) of Schedule 14(a) and add the required disclosures when there is a change in advisory fees (even though the fees are less). |

RESPONSE: The Company has revised the proxy statement by adding the disclosures required by Item 22(c)(9) under the heading entitled “Advisory Fee.”

| 28. | Please make sure that when the Board approved the New Investment Advisory Agreement, the Board considered that the Advisor will be reimbursed for certain costs and expenses under the Agreement. |

RESPONSE: The Company has confirmed that the Board considered the reimbursement of costs and expenses when approving the New Investment Advisory Agreement and the proxy statement has been revised in response to this comment.

| 29. | Please add “reckless disregard of obligations and duties under the Investment Advisory Agreement” as an exception to Indemnification. |

RESPONSE: The Company’s Board has considered and approved the change to the New Investment Advisory Agreement regarding indemnification and the proxy statement and New Investment Advisory Agreement have been revised in response to this comment.

| 30. | Please add the provisions of the Charter being amended under the Articles of Amendment as reference. |

RESPONSE: The Company has added a new Exhibit A-1 with the current Charter provisions that are being amended by the Articles of Amendment in response to this comment.

| 31. | Please review the SEC Division of Investment Management, February 2014 article on “bundling” and consider whether there are any other items being bundled under the proxy statement. |

RESPONSE: The Company has reviewed the suggested article and the proxy statement and does not believe that any other items are being bundled under the proxy statement.

With the approval of the staff, Princeton Capital plans to include the revisions in response to the staff’s comment in the definitive proxy statement.

In submitting this Correspondence Filing, Princeton Capital acknowledges that (i) it is responsible for the adequacy and accuracy of the disclosure in the filing, (ii) staff comments or changes to disclosure in response to staff comments in the filing do not foreclose the Commission from taking any action with respect to the filing and (iii) it may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

| Sincerely, | ||

| /s/William E. Carlson | ||

| William E. Carlson | ||

| cc: | Munish Sood | |

| Gregory J. Cannella |

EXHIBIT A

Preliminary Proxy Redline

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Princeton Capital Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid: | |||

| (2) | Form, schedule or registration statement no.: | |||

| (3) | Filing party: | |||

| (4) | Date filed: | |||

PRINCETON CAPITAL CORPORATION

4422 Route 27

Building C, Suite 1

Box 89

Kingston, New Jersey 08528-0089

(609) 514-9200

May [___], 2016

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Princeton Capital Corporation to be held on Thursday, June 9, 2016 at 9:30 a.m., Eastern Time, at 250 West Pratt Street, Suite 2000, Baltimore, Maryland 21201. Only stockholders of record at the close of business on [May 18], 2016 are entitled to the notice of, and to vote at, the Annual Meeting, including any postponement or adjournment thereof.

Details regarding the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

It is important that you be represented at the Annual Meeting, and you are encouraged to vote your shares as soon as possible. If you are unable to attend the meeting in person, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided. If you prefer, you can save time by voting through the Internet or by telephone as described in the proxy statement and on the enclosed proxy card. Your vote is important.

Sincerely yours,

Munish Sood

Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 9, 2016.

Our proxy statement and annual report on Form 10-K for the year ended December 31, 2014 are available at the following cookies-free website that can be accessed anonymously: www.voteproxy.com.

PRINCETON CAPITAL CORPORATION

4422 Route 27

Building C, Suite 1

Box 89

Kingston, New Jersey 08528-0089

(609) 514-9200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 9, 2016

To the Stockholders of Princeton Capital Corporation:

The first Annual Meeting of Stockholders (the “Annual Meeting”) of Princeton Capital Corporation, a Maryland corporation (the “Company”), will be held at 250 West Pratt Street, Suite 2000, Baltimore, Maryland 21201 on June 9, 2016, at 9:30 a.m. Eastern Time, to consider and vote on the following proposals:

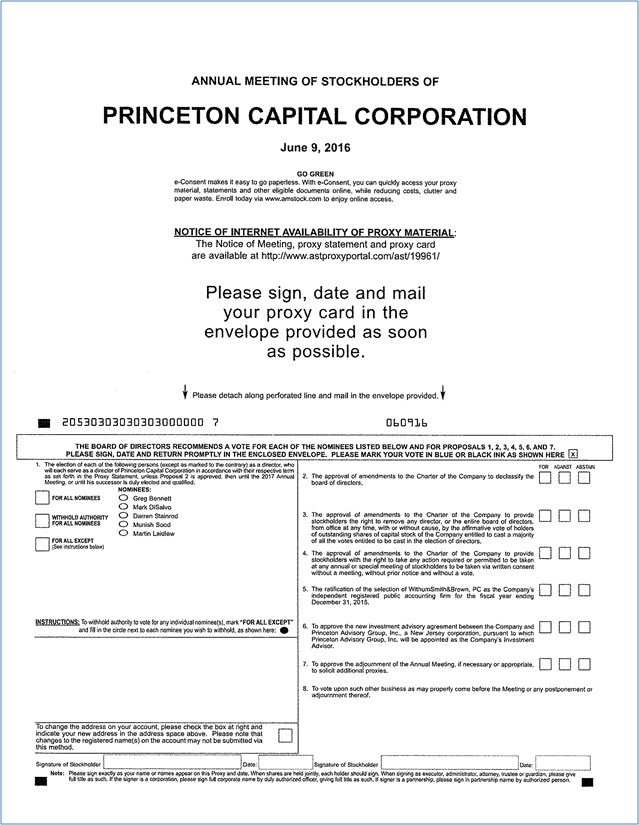

| 1. | The election of five (5) directors, two Class I directors, one Class II director, and two Class III directors, of the Company; | |

| 2. | To approve amendments to the Charter of the Company to declassify the board of directors of the Company; | |

| 3. | To approve amendments to the Charter of the Company to provide stockholders the right to remove any director, or the entire board of directors, from office at any time, with or without cause, by the affirmative vote of holders of outstanding shares of capital stock of the Company entitled to cast a majority of all the votes entitled to be cast in the election of directors; | |

| 4. | To approve amendments to the Charter of the Company to provide stockholders with the right to take any action required or permitted to be taken at any annual or special meeting of stockholders to be taken via written consent without a meeting, without prior notice and without a vote, as further described herein; | |

| 5. | To ratify the selection of WithumSmith&Brown, PC as the Company’s independent registered public accounting firm for the year ending December 31, 2015; | |

| 6. | To approve the new investment advisory agreement between the Company and Princeton Advisory Group, Inc., a New Jersey corporation, pursuant to which Princeton Advisory Group, Inc. will be appointed as the Company’s investment advisor; | |

| 7. | To approve the adjournment of the Annual Meeting, if necessary or appropriate, to solicit additional proxies; and | |

| 8. | To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, RECOMMENDS THAT YOU VOTE “FOR” EACH OF THESE PROPOSALS.

The enclosed proxy statement is also available at www.princetoncapitalcorp.com (under the “Investor Relations” section). This website also includes copies of the form of proxy and the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 (the “Annual Report”). Stockholders may request a copy of the proxy statement and the Company’s Annual Report by contacting our main office at (609) 514-9200. As of the date of this proxy statement, the Company has failed to timely file its quarterly reports on Form 10-Q for the quarters ended on March 31, 2015, June 30, 2015, and September 30, 2015 and its Annual Report on Form 10-K for the year ended December 31, 2015. The Company is working diligently to complete the Form 10-K and the past due Form 10-Qs.

You have the right to receive notice of and to vote at the Annual Meeting if you were a stockholder of record at the close of business on [May 18], 2016. Whether or not you expect to be present in person at the Annual Meeting, please sign the enclosed proxy and return it promptly in the self-addressed envelope provided. As a registered stockholder, you may also authorize your proxy by telephone or over the Internet by following the instructions included with your proxy card. Instructions are shown on the proxy card. In the event there are not sufficient votes for a quorum or to approve any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be postponed or adjourned in order to permit further solicitation of the proxies by the Company.

By Order of the Board,

Gregory J. Cannella

Secretary

May [__], 2016

This is an important meeting. To ensure proper representation at the Annual Meeting, please complete, sign, date and return the proxy card in the enclosed, self-addressed envelope. You may also authorize your proxy by telephone or over the Internet by following the instructions included with your proxy card. Even if you vote your shares prior to the Annual Meeting, you still may attend the Annual Meeting and vote your shares in person.

TABLE OF CONTENTS

|

Page | ||

| GENERAL | 6 | |

| ANNUAL MEETING INFORMATION | ||

| VOTING INFORMATION | ||

| INFORMATION REGARDING THIS SOLICITATION | ||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||

| PROPOSAL 1: ELECTION OF DIRECTORS | ||

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | ||

| PROPOSAL 2-4: APPROVAL OF AMENDMENTS TO THE CHARTER | ||

| PROPOSAL 5: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||

| PRINCIPAL ACCOUNTANT FEES AND SERVICES | 29 | |

| AUDIT COMMITTEE REPORT | 31 | |

| PROPOSAL 6: APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT | ||

| PROPOSAL 7: ADJOURNMENT OF THE ANNUAL MEETING | ||

| OTHER BUSINESS | ||

| SUBMISSION OF STOCKHOLDER PROPOSALS | ||

| PRIVACY PRINCIPLES | ||

| EXHIBIT A: ARTICLES OF AMENDMENT | ||

| EXHIBIT A-1: CHARTER PROVISIONS PRIOR TO ARTICLES OF AMENDMENT | 40 | |

| EXHIBIT B: NEW INVESTMENT ADVISORY AGREEMENT | ||

| EXHIBIT C: PROXY CARD |

PRINCETON CAPITAL CORPORATION

4422 Route 27

Building C, Suite 1

Box 89

Kingston, New Jersey 08528-0089

(609) 514-9200

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

GENERAL

Preliminary Copies – Subject to Completion

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Princeton Capital Corporation, a Maryland corporation (the “Company,” “we,” “us” or “our”), for use at the Company’s first Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 250 West Pratt Street, Suite 2000, Baltimore, Maryland 21201 on June 9, 2016, at 9:30 a.m., Eastern Time and at any postponements or adjournments thereof. This proxy statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “Annual Report”) are first being sent to stockholders on or about May [__], 2016.

The Annual Meeting was delayed pending resolution of the lawsuit captioned Capital Link Fund I, LLC, et al. v. Capital Point Management, LP, et al., C.A. No. 11483-VCN in the Court of Chancery of the State of Delaware (the “Litigation”). As reported in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on January 22, 2016, the Company and certain other defendants in the Litigation, including certain members of the Board (the “Settling Defendants”), entered into a settlement agreement on January 19, 2016 (the “Settlement Agreement”), pursuant to which the disputes involving the Settling Defendants described in the Litigation were settled, subject to the terms and conditions contained in the Settlement Agreement. Under the Settlement Agreement, the Company agreed to call the Annual Meeting for the purposes of the Company’s stockholders voting on, among other things, (i) the election of Darren Stainrod and Mark DiSalvo as Class I Directors and Martin Laidlaw and Greg Bennett as Class III Directors of the Company, (ii) the approval of the new investment advisory agreement between the Company and Princeton Advisory Group, Inc., a New Jersey corporation (the “New Investment Advisory Agreement”), and (iii) the approval of the certain amendments to the charter of the Company as described in more detail elsewhere in this proxy statement. Alfred Jackson, one of the current directors of the Company, was among the non-settling defendants to the Litigation. Litigation against certain of the non-settling defendants continues, including Mr. Jackson, Princeton Investment Advisors, LLC, Capital Point Management, LP, and Capital Point Advisors, LP, but there have been no developments since the settlement with the Settling Defendants on January 19, 2016. We encourage our stockholders to read the full text of the Settlement Agreement for further information on the parties and a description of the matters alleged in the Litigation which can be found as an attachment to the Form 8-K filed on January 22, 2016.

As reported in the Company’s Forms NT 10-Q filed with the SEC on May 18, 2015 and August 14, 2015, the Company has been unable to file its quarterly reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015 without unreasonable effort and expense because the Company’s auditors at the time, Crowe Horwath LLP (“Crowe”), needed additional time to conduct their review of the Company’s acquisition of the investment portfolio and certain other assets of Capital Point Partners, LP and Capital Point Partners II, LP, which occurred on March 13, 2015. As reported in the Company’s Current Report on Form 8-K filed with the SEC on October 22, 2015, Crowe informed the Company that it was resigning as the Company’s independent registered public accounting firm effective as of October 19, 2015.

As reported in the Company’s Current Report on Form 8-K filed with the SEC on March 21, 2016, on March 15, 2016, and effective the same date, the Audit Committee of the Board of Directors of the Company authorized and approved the engagement of WithumSmith&Brown, PC, as its independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending December 31, 2015 and to perform procedures related to the financial statements to be included in the Company’s quarterly reports on Form 10-Q, beginning with the quarter ended March 31, 2015. As a result of the change in the Company’s accounting firm, the Company has continued to be delayed in filing these quarterly reports with the SEC as well as its annual report on Form 10-K for the fiscal year ended December 31, 2015. The Company is working diligently with WithumSmith&Brown, PC to file these quarterly reports and annual report with the SEC as soon as possible. On March 30, 2016, the Company reported on its Form NT 10-K filed with the SEC that it would not be able to file its annual report on Form 10-K for the fiscal year ended December 31, 2015 for these reasons.

We encourage you to vote your shares, either by voting in person at the Annual Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card and the Company receives it in time for the Annual Meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. This proxy statement is also available via the Internet at www.princetoncapitalcorp.com (under the “Investor Relations” section). The website also includes electronic copies of the form of proxy and the Annual Report.

6

ANNUAL MEETING INFORMATION

Date and Location

We will hold the Annual Meeting on Thursday, June 9, 2016, at 9:30 a.m. Eastern Time at 250 West Pratt Street, Suite 2000, Baltimore, Maryland 21201.

Admission

Only record or beneficial owners of the Company’s common stock as of the close of business on [May 18], 2016 or their proxies may attend the Annual Meeting. Beneficial owners must also provide evidence of stock holdings, such as a recent brokerage account or bank statement.

Purpose of the Annual Meeting

At the Annual Meeting, you will be asked to vote on the following proposals:

| 1. | The election of five (5) directors, two (2) Class I directors, one (1) Class II director, and two (2) Class III directors, of the Company; | |

| 2. | The approval of amendments to the Charter of the Company to declassify the board of directors of the Company; | |

| 3. | The approval of amendments to the Charter of the Company to provide stockholders the right to remove any director, or the entire board of directors, from office at any time, with or without cause, by the affirmative vote of holders of outstanding shares of capital stock of the Company entitled to cast a majority of all the votes entitled to be cast in the election of directors; | |

| 4. | The approval of amendments to the Charter of the Company to provide stockholders with the right to take any action required or permitted to be taken at any annual or special meeting of stockholders to be taken via written consent without a meeting, without prior notice and without a vote, as further described herein; | |

| 5. | The ratification of selection of WithumSmith&Brown, PC as the Company’s independent registered public accounting firm for the year ending December 31, 2015; | |

| 6. | The approval of the new investment advisory agreement between the Company and Princeton Advisory Group, Inc., a New Jersey corporation, pursuant to which Princeton Advisory Group, Inc. will be appointed as the Company’s Investment Advisor; | |

| 7. | To approve the adjournment of the Annual Meeting, if necessary or appropriate, to solicit additional proxies; and | |

| To transact such other business as may properly come before the meeting, or any postponement or adjournment thereof. |

7

VOTING INFORMATION

Record Date and Quorum Required

The record date of the Annual Meeting is the close of business on [May 18], 2016 (the “Record Date”). You may cast one vote for each share of our common stock that you own of record as of the Record Date.

A quorum of stockholders must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast as of the Record Date will constitute a quorum. Abstentions will be treated as shares present for quorum purposes. Shares held in “street name” by a bank, broker or other nominee, and for which the nominee has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares on certain proposals (“Broker Non-Votes”) will be treated as shares present for quorum purposes. On the Record Date, there were [120,486,061] shares of our common stock outstanding and entitled to vote. Thus, [60,363,517] shares of our common stock must be present at the Annual Meeting in person or by proxy to have a quorum.

If a quorum is not present at the Annual Meeting, the stockholders who are

represented may adjourn the Annual Meeting until a quorum is present. The persons named as proxies willmay

vote those proxies for such adjournment, unless marked to be voted against any proposal

for which an if Proposal 7 on the attached Proxy Card

is marked for such adjournment is sought, to permit further solicitation of proxies.

Submitting Voting Instructions for Shares Held Through a Broker

If you hold shares of common stock in “street name” through a broker, bank or other nominee, you must follow the instructions you receive from your broker, bank or nominee in order to provide voting instructions to your broker, bank or nominee. If you hold shares of our common stock through a broker, bank or other nominee and you want to vote in person at the Annual Meeting, you must obtain a legal proxy from the record holder of your shares and present it at the meeting. If you do not submit voting instructions to your broker, bank or other nominee, your broker, bank or other nominee will be permitted to vote in its discretion on Proposal 5, to ratify the selection of WithumSmith&Brown, PC as the Company’s independent registered public accounting firm for the year ending December 31, 2015, but will not be permitted to vote your shares on any other proposal considered at the Annual Meeting.

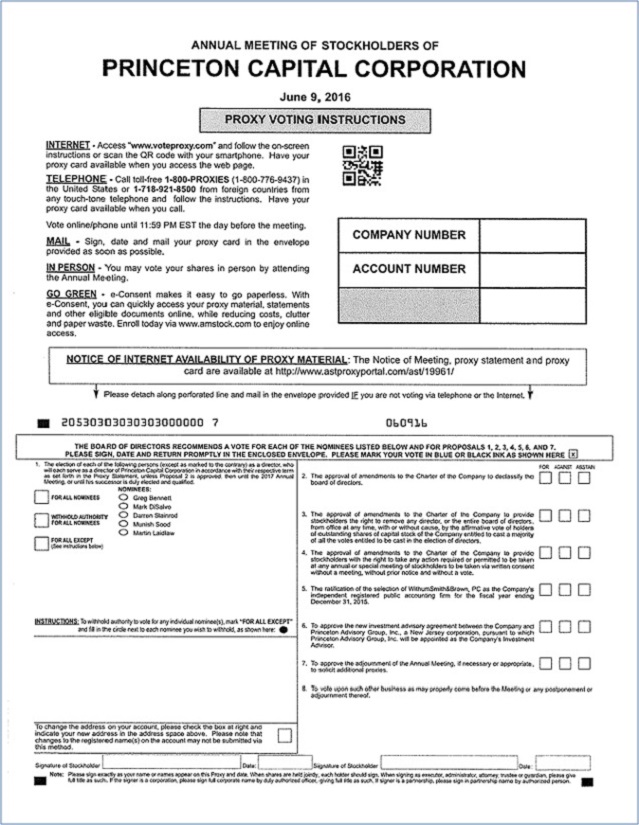

Authorizing a Proxy for Shares Held in Your Name

If you are a record holder of shares of our common stock, you may authorize a proxy to vote on your behalf by mail, as described on the enclosed proxy card. If you are a stockholder of record, you may also authorize a proxy and provide voting instructions via telephone or Internet by following the instructions on the proxy card. Authorizing a proxy will not limit your right to vote in person at the Annual Meeting. A properly completed, executed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke the proxy. If you authorize a proxy without indicating your voting instructions, the proxy holder will vote your shares according to the Board’s recommendations.

Revoking Your Proxy

If you are a stockholder of record, you can revoke your proxy by (1) delivering a written revocation notice prior to the Annual Meeting to our Secretary, Gregory J. Cannella, at 4422 Route 27, Building C, Suite 1, Box 89, Kingston, New Jersey 08528-0089; (2) delivering a later-dated proxy that we receive no later than the opening of the polls at the Annual Meeting; or (3) voting in person at the Annual Meeting. If you hold shares of common stock through a broker, bank or other nominee, you must follow the instructions you receive from your nominee in order to revoke your voting instructions. Attending the Annual Meeting does not revoke your proxy unless you also vote in person at the Annual Meeting.

8

Vote Required

|

Proposal |

Vote Required |

Broker Discretionary Voting Allowed |

Effect of Abstentions and Broker Non-Votes | |||

| Proposal 1 — The election of five (5) directors, two (2) Class I directors, one Class II director and two (2) Class III directors, of the Company. | Affirmative vote of the holders of a plurality1 of the votes cast in the election of directors at the Annual Meeting. | No | Abstentions and broker non-votes, if any, are not votes cast and, as a result, will have no effect on the outcome of the election of directors. | |||

| Proposal 2 — The approval of amendments to the Charter of the Company to declassify the board of directors of the Company. | Affirmative vote of the holders of at least 80 percent of the votes entitled to be cast on the matter2. | No | Abstentions and broker non-votes, if any, will have the same effect of a vote against this proposal. | |||

|

Proposal 3 — The approval of amendments to the Charter of the Company to provide stockholders the right to remove any director, or the entire board of directors, from office at any time, with or without cause, by the affirmative vote of holders of outstanding shares of capital stock of the Company entitled to cast a majority of all the votes entitled to be cast in the election of directors. |

Affirmative vote of the holders of at least 80 percent of the votes entitled to be cast on the matter. | No | Abstentions and broker non-votes, if any, will have the same effect of a vote against this proposal. | |||

| Proposal 4 — The approval of amendments to the Charter of the Company to provide stockholders with the right to take any action required or permitted to be taken at any annual or special meeting of stockholders to be taken via written consent without a meeting, without prior notice and without a vote. |

Affirmative vote of the holders of at least two-thirds of the votes entitled to be cast on the matter.

|

No | Abstentions and broker non-votes, if any, will have the same effect of a vote against this proposal. | |||

| Proposal 5 — To ratify the selection of WithumSmith&Brown, PC as the Company’s independent registered public accounting firm for the year ending December 31, 2015. | Affirmative vote of a majority of the votes cast at the Annual Meeting. | Yes | Abstentions and broker non-votes, if any, are not votes cast and, as a result, will have no effect on this proposal. | |||

| Proposal 6 — The approval of the new investment advisory agreement between the Company and Princeton Advisory Group, Inc., a New Jersey corporation, pursuant to which Princeton Advisory Group, Inc. will be appointed as the Company’s Investment Advisor. |

Affirmative vote of a majority of the outstanding shares of the Company’s common stock entitled to vote at the Annual Meeting.

|

No | Abstentions and broker non-votes, if any, will have the same effect of a vote against this proposal. | |||

| Proposal 7 — To approve the adjournment of the Annual Meeting, if necessary or appropriate, to solicit additional proxies. | Affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting. | No | Abstentions and broker non-votes, if any, are not votes cast and, as a result, will have no effect on this proposal. |

1 Plurality means the individual who gets the most votes, regardless of whether or not such individual obtains a majority of the votes.

2 “Votes entitled to be cast on the matter” in Proposals 2-4 means all of the outstanding shares of common stock of the Company, as the Company only has one class of shares outstanding.

Ownership by Capital Point Partners, LP and Capital Point Partners II, LP

Capital Point Partners, LP and Capital Point Partners II, LP (the “Partnerships”) beneficially own [104,562,000] and [10,922,327] shares of the Company’s common stock, respectively, representing approximately [96%] of the Company’s outstanding common stock and voting power. We entered into an agreement with the Partnerships concerning their obligations pursuant to Section 12(d)(1)(e) of the Investment Company Act of 1940, as amended (the “1940 Act”). Under this Agreement, the Partnerships will either (i) seek instructions from those holding interests in the Partnerships with regards to voting proxies issued by the Company or (ii) vote the shares of the Company’s common stock they own in the same proportion “for” and “against” each proposal as all of our other stockholders vote their shares of the Company’s common stock on each of the matters to be voted on by stockholders at the Annual Meeting.

9

INFORMATION REGARDING THIS SOLICITATION

Our Board is making this solicitation and the Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing, and mailing this proxy statement, the accompanying Notice of Annual Meeting of Stockholders, and the proxy card. If brokers, trustees, or fiduciaries and other institutions or nominees holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies form, such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in person and/or by telephone or facsimile transmission by directors, officers or employees of the Company. No additional compensation will be paid to directors, officers or employees of the Company for such services.

Stockholders may also authorize a proxy and provide their voting instructions by telephone and through the Internet. This option requires stockholders to input the Control Number which is located on each proxy card. After inputting this number, stockholders will be prompted to provide their voting instructions. Stockholders authorizing a proxy via the Internet will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their Internet link. Stockholders who authorize a proxy via the Internet, in addition to confirming their voting instructions prior to submission, will also receive an e-mail confirming their instructions upon request.

If a stockholder wishes to participate in the Annual Meeting, but does not wish to give a proxy electronically, the stockholder may still submit the proxy card originally sent with this Proxy Statement or attend the Annual Meeting in person.

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokerages and other institutional holders of record have implemented householding. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. If you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker. Stockholders who currently receive multiple copies of the proxy statement at their addresses and would like to request information about householding of their communications should contact their brokers or other intermediary holder of record. You can notify us by sending a written request to: Gregory J. Cannella, Secretary, Princeton Capital Corporation, 4422 Route 27, Building C, Suite 1, Box 89, Kingston, New Jersey 08528, or by calling (609) 514-9200.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of [May 18], 2016, the beneficial ownership of each current director, each nominee for director, the Company’s executive officers, each person known to us to beneficially own 5% or more of the outstanding shares of the Company’s common stock, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of [May 18], 2016 are deemed to be outstanding and beneficially owned by the person holding such options or warrants. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Percentage of ownership is based on [120,486,061] shares of the Company’s common stock outstanding as of [May 18], 2016.

Unless otherwise indicated, to our knowledge, each stockholder listed below has sole voting and investment power with respect to the shares beneficially owned by the stockholder, except to the extent authority is shared by their spouses under applicable law. Unless otherwise indicated, the address of all executive officers and directors is c/o Princeton Capital Corporation, 4422 Route 27, Building C, Suite 1, Box 89, Kingston, New Jersey 08528.

The Company’s

directors are divided into two groups —-

interested directors and independent directors. Interested directors are “interested persons” as defined

in Section 2(a)(19) of the 1940 Act.

and the NASDAQ (“NASDAQ”) Stock Market Rules, as the Over the Counter Pink (“OTCPK”) exchange where the

Company trades, does not establish director independence standards.

| Name and Address of Beneficial Owner | Number of Shares Owned Beneficially(1) | Percentage of Class | ||||||

| Interested Directors | ||||||||

| Alfred Jackson(2) | 1,186,581 | * | ||||||

| Munish Sood | 0 | * | ||||||

| Independent Directors | ||||||||

| Thomas Jones, Jr. | 0 | * | ||||||

| Trennis L. Jones | 0 | * | ||||||

| Martin Laidlaw | 0 | * | ||||||

| Darren Stainrod | 0 | * | ||||||

| Interested Director Nominees | ||||||||

| Mark S. DiSalvo(3) | 115,484,327 | 95.9 | % | |||||

| Independent Director Nominees | ||||||||

| Greg Bennett | 0 | * | ||||||

| Executive Officers | ||||||||

| Gregory J. Cannella | 0 | * | ||||||

| Joy Sheehan | 0 | * | ||||||

| Executive officers and directors as a group | 115,484,327 | 95.9 | % | |||||

| Greater than 5% Holders | ||||||||

| Capital Point Partners, LP (4) | 104,562,000 | 86.8 | % | |||||

| Capital Point Partners II, LP(4) | 10,922,327 | 9.07 | % | |||||

* Less than 1%

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended. |

11

| (2) | Mr. Jackson, by virtue of his control of Capital Point Management, LP, Capital Point Partners II, LLC, and Capital Point Partners II SLP, LP, may be deemed to be the beneficial owner of the 1,033,029 shares of the Company’s common stock owned by Capital Point Management, LP, the 138,197 shares of the Company’s common stock owned by Capital Point Partners II, LLC, and the 15,355 shares of the Company’s common stock owned by Capital Point Partners II SLP, LP. |

| (3) | Mr. DiSalvo, by virtue of his ownership of all of the outstanding stock of Sema4, Inc., the general partner of Capital Pointer Partners, LP (“CPP”) and Capital Point Partners II, LP (“CPP II”), may be deemed to be the beneficial owner of the 104,562,000 shares of the Company’s common stock owned by CPP and the 10,922,327 shares of the Company’s common stock owned by CPP II. Mr. DiSalvo and Sema4, Inc. each disclaims beneficial ownership of any shares held by CPP and CPP II, except to the extent of their pecuniary interest therein. The address of Sema4, Inc., CPP and CPP II is 800 Turnpike Street, Suite 300, North Andover, MA 01854. |

| (4) | This information is based on information included in the Schedule 13D filed with the SEC. |

The following table sets forth as of [May 18], 2016, the dollar range of our securities owned by our directors and executive officers.

|

Name |

Dollar Range of Equity Securities Beneficially Owned(1)(2) | |

| Interested Director: | ||

| Alfred Jackson | Over $100,000 | |

| Munish Sood | None | |

| Independent Directors: | ||

| Thomas Jones, Jr. | None | |

| Trennis L. Jones | None | |

| Martin Laidlaw | None | |

| Darren Stainrod | None | |

| Interested Director Nominees: | ||

| Mark S. DiSalvo | Over $100,000 | |

| Independent Director Nominees: | ||

| Greg Bennett | None | |

| Executive Officers: | ||

| Gregory J. Cannella | None | |

| Joy Sheehan | None |

| (1) | The dollar range of the equity securities beneficially owned is based on the closing price per share of the Company’s common stock of [$___] on May [__], 2016 on the |

| (2) | The dollar ranges of equity securities beneficially owned are: none; $1–$10,000; $10,001–$50,000; $50,001–$100,000; and over $100,000. |

12

PROPOSAL 1: ELECTION OF DIRECTORS

Our business and affairs are managed under the direction of our Board. Pursuant to the Company’s Charter and bylaws, the number of directors on our Board is currently fixed at six directors and is divided into three classes. Each director holds office for the term to which he or she is elected and until his or her successor is duly elected and qualified. Currently, the successors to the class of directors whose terms expire at an annual meeting will be elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following the year of their election and until their successors have been duly elected and qualified or any director’s earlier resignation, death or removal. Pursuant to Proposal 2, the Company’s stockholders are being asked to vote on an amendment to the Company’s Charter that would declassify the Board and shorten the term of all directors to one year.

As described at the beginning of this proxy statement, the Annual Meeting was delayed pending resolution of the Litigation. As a result of this delay, the terms of directors Alfred Jackson and Darren Stainrod, who are Class I directors, and Munish Sood and Trennis L. Jones, who are Class II directors, are expiring at the Annual Meeting. Messrs. Jackson and Jones will not be standing for re-election and accordingly, their terms as directors of the Company will expire at the Annual Meeting. Messrs. Stainrod and Sood have been nominated for election as directors, with Mr. Stainrod’s term expiring in 2018 and Mr. Sood’s term expiring in 2019, subject to their conditional resignations at the Company’s 2017 annual meeting of stockholders in the event Proposal 2 is approved by the Company’s stockholders, as described in more detail below.

Pursuant to the Settlement

Agreement, Thomas Jones Jr., a Class III director whose current term expires in 2017, has agreed to resign as a director of the

Company on the date immediately following the Annual Meeting. TheSince

fewer nominees are named for director than the number fixed by the Charter of the Company, the proxies cannot be voted for a greater

number of persons than the number of nominees named. The Company’s stockholders are not being asked to vote separately on

an amendment to the Company’s Charter to reduce the size of the Board because the Company’s Charter and Bylaws delegate

the power to reduce the size of the Board solely to the Board and not to the Company’s stockholders. If the stockholders

approve Proposal 2, the Company intends to reduce the size of the Board from six to five directors immediately following

Mr. Jones’ resignation. Pursuant to Article III, Section 2 of

the Company’s Bylaws, the Board has already authorized the reduction in the size of the Board from six to five directors.

In addition, pursuant to the Settlement Agreement, the Company agreed to call this Annual Meeting for the purpose of the Company’s

stockholders voting on, among other things, the election of Mark DiSalvo and Darren Stainrod as Class I directors and Greg Bennett

and Martin Laidlaw as Class III directors of the Company.

While the Company acknowledges that Class III Directors’ terms do not expire until 2017, the Company and Mr. Laidlaw, as a current Class III director, have agreed that the Class III Directors will stand for election this year so that the Company can continue to comply with Section 16(a) of the 1940 Act. Section 16(a) of the 1940 Act requires that at least two-thirds of the directors of a registered investment company must have been elected to such office by the holders of the outstanding voting securities of the company at an annual or special meeting.

Each of Messrs. Stainrod, Sood, Laidlaw, DiSalvo and Bennett has indicated his willingness to serve as a director if elected and has consented to be named as a nominee. Mr. Sood is not being nominated to serve as a director pursuant to any agreement or understanding between him and the Company. The other nominees are being nominated pursuant to the Settlement Agreement.

With the exception of the Class III director nominees, each director nominee has been nominated for a multiyear term of office in accordance with the Company’s Charter. However, in the event the stockholders of the Company approve Proposal 2 at the Annual Meeting and the Board is declassified, all such directors have agreed to resign from the Board at the 2017 annual meeting of the Company’s stockholders. In this regard, subject to and conditioned upon the approval of Proposal 2 by the Company’s stockholders, beginning with the 2017 annual meeting of the Company’s stockholders, all directors would hold office for one year and until his or her successor was duly elected and qualified. For additional details regarding the amendment to the Company’s Charter that would declassify the Board and shorten the terms of directors to one-year terms please see Proposal 2 below.

A stockholder can vote for or withhold his or her vote for each of the nominees. In the absence of instructions to the contrary, the persons named as proxies will vote such proxy FOR the election of the nominees named in this proxy statement. If any of the nominees should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that any of the nominees will be unable or unwilling to serve.

13

Information about the Nominees and Directors

As described below under “Committees of the board of directors — Nominating and Corporate Governance Committee,” the Board has identified certain desired attributes for director nominees. Each of our directors and the director nominees has demonstrated high character and integrity, superior credentials and recognition in his respective field and the relevant expertise and experience upon which to be able to offer advice and guidance to our management. Each of our directors and the director nominees also has sufficient time available to devote to the affairs of the Company, is able to work with the other members of the Board and contribute to the success of the Company and can represent the long-term interests of the Company’s stockholders as a whole. Our directors and the director nominees have been selected such that the Board represent a range of backgrounds and experience.

Certain information,

as of the Record Date, with respect to the director nominees, as well as each of the current directors, is set forth below, including

their names, ages, a brief description of their recent business experience

during the past five years, including present occupations and employment, certain

directorships that each person holds and has held in

the past five years, the year in which each person became a director of the Company, and a discussion of their particular

experience, qualifications, attributes or skills that lead us to conclude, as of the Record Date, that such individual should

serve as a director of the Company, in light of the Company’s business and structure.

The business address of the nominees and the directors listed below is 4422 Route 27, Building C, Suite 1, Box 89, Kingston, New Jersey 08528.

Nominees for Directors

Mr. DiSalvo is an “interested person” of the Company as defined in the 1940 Act and NASDAQ Rules due to his controlling interest in Sema4, Inc., which is the general partner of Capital Point Partners, LP and Capital Point Partners II, LP. Mr. Sood is an “interested person” of the Company as defined in the 1940 Act and NASDAQ Rules due to his position as the Company’s Chief Executive Officer and his interests in Princeton Investment Advisors, the current investment advisor of the Company and Princeton Advisory Group, the proposed new investment advisor of the Company. Each of Messrs. Stainrod, Laidlaw and Bennett is not an “interested person” of the Company as defined in the 1940 Act and the NASDAQ Rules.

Nominees for Class I Directors — Term Expiring 2018

Interested Director

Mark DiSalvo, 61, is the President and CEO of Sema4, Inc., a leading global professional services provider of private equity funds-under-management. He has been a senior executive and entrepreneur at international companies such as Euromoney Institutional Investor and Fairfield Whitney, and was founder of Hall, Berwick and DiSalvo where he provided funding and management advisory services to zero and first stage entities prior to founding Sema4. He has extensive experience in private equity, entrepreneurial management, and emerging market strategy, particularly as to underserved markets and economic development. A frequent speaker at worldwide industry conferences, he is a charter member of the Inner City Economic Forum. Mr. DiSalvo was educated at the University of Massachusetts with degrees in Political Studies and Economics and has earned the professional designations CPC and CTA. He is a long-time lecturer at the Johnson School of Business at Cornell University and the Kellogg School of Business at Northwestern University in their full-time MBA programs where he contributes case studies in private equity, emerging market economics and cross-border M&A. We believe Mr. DiSalvo’s broad experience with private equity funds and early stage growth companies makes him a well-qualified nominee for election to our Board.

Independent Director

Darren Stainrod,

51, serves as the Chairman of the Company’s Board.

and was appointed to the Company’s Board on January 18, 2016. Mr. Stainrod is a Principal of Marbury Fund Services

(Cayman) Limited (“Marbury”), a fiduciary services company focused on the alternative investment industry and licensed

by the Cayman Islands Monetary Authority. He is registered as a director with the Authority pursuant to the Directors Licensing

and Registration Law, 2014. Prior to joining Marbury, Mr. Stainrod was a Principal at HighWater Limited in Cayman for almost 3

years where he provided professional director services to hedge funds, fund of funds and private equity vehicles. Before becoming

a professional director in May 2013, Mr. Stainrod spent 17 years at UBS where he was a Managing Director and the Global Head of

UBS Alternative Fund Services. At UBS he had responsibility for the overall management and development of the global hedge fund

administration business in seven countries with more than 300 staff servicing alternative investment funds with over $200 billion

in assets under administration. Mr. Stainrod has over 27 years of experience in the investment fund industry, including 23 years

offshore. Before joining UBS, he worked for three years with Coopers & Lybrand in Cayman and four years with Deloitte in the

UK. Mr. Stainrod holds a BA (Hons) in Politics from the University of Reading in the UK. He is a member of the Institute of Chartered

Accountants in England and Wales and the Cayman Islands Society of Professional Accountants. He is a past Chairman of the Cayman

Islands Fund Administrators Association and is the current Treasurer of AIMA Cayman Chapter. Mr. Stainrod brings to the Board

extensive experience as a director of hedge funds, fund of funds and private equity funds as well as considerable experience in

the investment fund industry, all of which provide our Board with valuable insight and supports Mr. Stainrod’s election

to our Board. Mr. Stainrod serves as chairman of the Company’s Nominating and Corporate Governance Committee and he is a

member of the Company’s Audit Committee and the Company’s Valuation Committee.

14

Nominees for Class II Directors — Term Expiring 2019

Interested Director

Munish Sood, CFA 43, serves as our Chief Executive Officer. He was elected to the Company’s Board on March 13, 2015. He is also a partner of Princeton Advisors, our current investment adviser, and founder and Chief Investment Officer of Princeton Advisory Group, Inc. (“PAG”), which was founded in 2002 to provide investment management services to Institutional and Family Office clients across multiple credit investment strategies. PAG would be a party to the new investment advisory agreement being voted upon by the Company’s stockholders pursuant to Proposal 6. Mr. Sood is responsible for sourcing, analyzing, structuring, and closing new investment opportunities as well as managing the Company’s portfolio investments. Mr. Sood is the Chief Investment Officer & Senior Portfolio Manager for PAG’s funds and managed accounts and is the chairman of PAG’s Investment Committee overseeing all investment strategies and products. PAG currently manages in excess of $500 million USD. Prior to forming PAG, Mr. Sood co-founded BoTree Investments, LLC, in 2001 where he was the Chief Investment Officer. Mr. Sood was responsible for managing and investing in structured product and overseeing all investment activity in Botree Asset Management, LLC. Prior to Botree, Mr. Sood was the Senior Portfolio Manager at Global Value Investors, Inc. from January 1999 to April 2001. Prior to Global Investors, Inc., Mr. Sood was a Senior Analyst/Trader at Penn Capital Management, Inc. From 1996 to 1998 he was an associate at Bankers Trust focusing on fixed income arbitrage. Mr. Sood received a Bachelor of Science in Finance & Accounting from Rider University. He holds a Chartered Financial Analyst designation and is a member of the CFA Institute. Mr. Sood is a founder of First Choice Bank in Lawrenceville, NJ and has served as a Director since 2007. Mr. Sood’s considerable experience in the investment management industry as well as his knowledge of and experience with our portfolio and investment strategy make him well qualified to serve on our Board.

Nominees for Class III Directors — Term Expiring 2017

Independent Directors

Martin Laidlaw, 59, who was elected by the Board of Directors (to fill a vacancy) to the Company’s Board on January 18, 2016, is a Director of Premier Fiduciary Services (Cayman) Ltd. and a former Managing Director of JP Fund Administration (Cayman) Ltd. (“JPFA”) and has over 25 years of experience in the offshore financial industry. Mr. Laidlaw has an extensive range of experience with all forms of investment fund products and has held numerous directorship positions for a wide variety of offshore fund vehicles. From 1989 to 2009 Mr. Laidlaw was employed with CIBC Bank and Trust Company (Cayman) Limited. He was appointed Director and Head of Fund Services and was responsible for leading the fund services team and developing new business and client relationships. Prior to his years at CIBC, he was employed with KPMG, Cayman Islands where he led various financial services audits. He was a founding member, Director and Treasurer of the Cayman Islands Fund Administrators Association. Martin graduated from Edinburgh University in Scotland with a Bachelor of Commerce Degree. He was admitted as a Member of the Institute of Chartered Accountants of Scotland in February, 1984 and continues to maintain his qualification. He is a Cayman Islands Monetary Authority Registered Director and is a member of The Alternative Investment Management Association (AIMA). Mr. Laidlaw’s extensive experience in the financial industry, including his financial and accounting background, and his experience as a director of various offshore fund vehicles makes him well qualified to serve on our Board. Mr. Laidlaw serves as chairman of the Company’s Audit Committee, chairman of the Valuation Committee and he is a member of the Nominating and Corporate Governance Committee.

15

Greg Bennett, 43, is the co-founder of Danesmead Partners. Mr. Bennett has more than eighteen years of experience in financial services having started his professional career with Coopers & Lybrand in Canada in 1996. From 2011 through 2014, prior to co-founding Danesmead Partners, Mr. Bennett was a Director of The Harbour Trust Co. Ltd., where he provided fiduciary services to their clients, including serving as an independent hedge fund director. In 2004 Mr. Bennett joined Butterfield Fund Services (Cayman) Limited as head of client relationship management and he became a Director of that firm in 2005. In 2008 he was promoted to Managing Director where he had responsibility for all aspects of the business, including managing over 75 staff responsible for providing full fund administration services to a wide range of hedge fund clients with in excess of $30billion in assets under management. In 2010 Mr. Bennett established the Cayman office of HedgeServ and held the position of Managing Director. Mr. Bennett graduated with a Bachelor of Commerce from the University of Alberta in Canada in 1995. He is a Chartered Accountant (Canada), a Certified Public Accountant (US), and a CFA Charterholder. Mr. Bennett is also a Director of Hedge Funds Care Cayman, past Deputy Chairman of the Cayman Islands Fund Administrators Association, past Treasurer of AIMA Cayman and a past President of the CFA Society of the Cayman Islands. Mr. Bennett’s considerable experience in the financial services industry and as a director of various hedge funds and his accounting background make him well qualified to serve on our Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

Current Directors

Mr. Jackson is an “interested person” of the Company as defined in the 1940 Act and NASDAQ Rules due to his controlling interest in Princeton Investment Advisors, the current investment advisor of the Company. Each of Thomas Jones Jr. and Trennis L. Jones is not an “interested person” of the Company as defined in the 1940 Act and the NASDAQ Rules.

Interested Director

Alfred Jackson, 58, elected to the Company’s Board on March 13, 2015, is a partner of Princeton Investment Advisors and is responsible for sourcing investment opportunities, investor relations, capital raising and overall firm strategy. Mr. Jackson has over 22 years of investment experience with institutional asset management firms. Mr. Jackson is the founder of the Inroads Group Ltd., an investment firm that includes several asset classes. He also spent 17 years as a principal with Davis Hamilton Jackson and Associates (“DHJA”), an institutional asset management firm with $4 billion under management, investing in public debt and equity securities. Prior to DHJA, Mr. Jackson was Vice President of the Institutional Fixed Income Division of Capital Municipal Securities. Mr. Jackson received his B.A. from The University of Texas at Austin. Mr. Jackson’s will not be standing for re-election and accordingly, his term as a director will expire at the Annual Meeting.

Independent Directors

Trennis L. Jones, 63, elected to the Company’s Board on March 13, 2015, has over 16 years of executive experience, including 8 years in key positions at companies in the financial services industry. From February 1999 to January 2002, Mr. Jones was a principal with Barclays Global Investors. From February 2002 to February 2007 he was with VALIC, formerly AIG Valic, where he was Senior Vice President/National Managing Director for the Higher Education of VALIC. Since March 2007 Mr. Jones has been Chief Administrative Officer and Chief Compliance Officer of Seton Family of Hospitals where he is responsible for risk management and corporate compliance amongst other areas. Mr. Jones was also on the Seton Board of Trustees from August 1998 until assuming his current position. Mr. Jones holds a B.S. in Government from Lamar University and a Masters in Business Administration from the University of Texas. Mr. Jones will not be standing for re-election and accordingly, his term as a director will expire at the Annual Meeting.

Thomas Jones Jr., 59, elected to the Company’s Board on March 13, 2015, is a founder of and partner in McConnell Jones Lanier & Murphy LLP (“MJLM”), an accounting and consulting firm based in Houston, Texas, where he supervises a staff of approximately 200 professional and administrative support personnel. Mr. Jones has over 35 years of experience in accounting, tax, treasury management, banking, and investment management services. He is also the sole manager of each of TKNET, LLC and Huntjon LLC, two real estate development companies. Mr. Jones serves on the board of directors of Spirit of Texas Bank, where he is a member of the senior loan committee and the compensation committee and serves as chairman of the bank’s audit committee. He was a founding board member of Royal Oaks Bank where he also serves on the senior loan committee and chairman of its audit committee. Prior to founding MJLM, Mr. Jones served as manager of the treasury management division of Chase Bank of Texas where he developed and marketed treasury and risk strategies and products to Fortune 500 and mid-sized companies. Mr. Jones holds both a Series 24 and Series 7 securities license through Homer Townsend and Kent, Inc., a registered investment advisory firm and broker/dealer and wholly-owned subsidiary of Penn Mutual Insurance Company. He is a past president of Dominion Community Development Corporation and a current board member of Florida A&M University Foundation, Inc. and the Greater Houston Convention and Visitors Bureau. Mr. Jones received his B.S. in Accounting from Florida A&M University. Pursuant to the Settlement Agreement, Mr. Jones, a Class III director whose current term expires in 2017, has agreed to resign as a director of the Company on the date immediately following the Annual Meeting.

16

Information about Directors and Executive Officers

Board of Directors

Pursuant to our Charter, our directors are currently divided into three classes. Typically, at each annual meeting, directors will be elected for staggered terms of three years (other than the initial terms of directors, which extended for up to three years), with the term of office of only one of these three classes of directors expiring at each annual meeting of our stockholders. Due to the delay in the Annual Meeting, the terms of Alfred Jackson, Darren Stainrod, Munish Sood and Trennis L. Jones are expiring at the Annual Meeting. Messrs. Jackson and Jones will not be standing for re-election and accordingly, their terms as directors of the Company will expire at the Annual Meeting.

Each director will hold office for the term to which he or she is elected and until his or her successor is duly elected and qualified. Notwithstanding the foregoing, if Proposal 2 is approved by the stockholders at the Annual Meeting, the Board will cease to be classified and beginning with the 2017 annual meeting of the Company’s stockholders, all directors would hold office for one year and until his or her successor was duly elected and qualified. In this regard, all director nominees (other than the Class III director nominees whose terms in office would expire at the 2017 annual meeting of the Company’s stockholders) have agreed to resign from the Board at the 2017 annual meeting of the Company’s stockholders.

The Board considered whether each of the director nominees is qualified to serve as a director, based on a review of the experience, qualifications, attributes and skills of each nominee, including those described above. The Board will also consider whether each director nominee has significant experience in the investment or financial services industries and has held management, board or oversight positions in other companies and organizations. For the purposes of this presentation, our directors and director nominees have been divided into two groups — independent directors and director nominees and interested directors and director nominees. Interested directors and director nominees are “interested persons” as defined in the 1940 Act and NASDAQ Rules.

|

Name |

Age |

Position |

Director Since |

Class |

Term Expires | |||||

| Interested Directors and Director Nominees | ||||||||||

| Alfred Jackson | 58 | Director | 2015 | I | 2015(1) | |||||

| Mark S. DiSalvo | 61 | Director Nominee | - | I | 2018 | |||||

| Munish Sood | 43 | Chief Executive Officer and President | 2015 | II | 2019 | |||||

| Independent Directors and Director Nominees | ||||||||||

| Martin Laidlaw | 59 | Director | 2016 | III | 2017 | |||||

| Greg Bennett | 43 | Director Nominee | - | III | 2017 | |||||

| Darren Stainrod | 51 | Director | 2016 | I | 2018 | |||||

| Thomas Jones, Jr. | 59 | Director | 2015 | III | 2017(2) | |||||

| Trennis L. Jones | 63 | Director | 2015 | II | 2016(3) |

| (1) | Mr. Jackson will not stand for re-election to the Board and accordingly, his term as a director will expire at the Annual Meeting. |

| (2) | Pursuant to the Settlement Agreement, Thomas Jones, Jr., whose current term expires in 2017, has agreed to resign as a director of the Company on the date immediately following the Annual Meeting. |

| (3) | Trennis L. Jones will not stand for re-election to the Board and accordingly, his term as a director will expire at the Annual Meeting. |

The address for each of our directors is c/o Princeton Capital Corporation, 4422 Route 27, Building C, Suite 1, Box 89, Kingston, New Jersey 08528.

17

Executive Officers Who Are Not Directors

Information regarding our executive officers who are not directors is as follows (such information includes each officer’s business experience during the past five years):

|

Name |

Age |

Position | ||

| Gregory J. Cannella | 41 | Chief Financial Officer, Treasurer and Secretary | ||

| Joy Sheehan | 49 | Chief Compliance Officer |

The address for each of our executive officers is c/o Princeton Capital Corporation, 4422 Route 27, Building C, Suite 1, Box 89, Kingston, New Jersey 08528.

Gregory J. Cannella,

41, serveshas served

as our Chief Financial Officer, Treasurer and Secretary.

since March 13, 2015. Mr. Cannella is responsible for financial reporting, investor communications, financial modeling

and due diligence and analysis of acquisitions and dispositions. Prior to this, Mr. Cannella was the Chief Financial Officer of

Capital Point Partners, a private equity group that focused on mezzanine lending to small and middle market private companies,

where he was responsible for financial reporting, investor communications, financial modeling and due diligence and analysis of

acquisitions and dispositions. Prior to working at Capital Point Partners, Mr. Cannella was an Asset Manager at First Commonwealth

Holdings Corp., a wealth management firm in Houston, Texas where he was responsible for managing various commercial and multi-family

residential real estate investment funds as well as oversight of accounting functions and reporting for the funds. Mr. Cannella

received a B.B.A. in Management from Stephen F. Austin State University and an M.B.A. with honors in Accounting and Finance from

the University of Houston. He is a Certified Public Accountant in the State of Texas.

Joy Sheehan, 49,

serveshas served

as our Chief Compliance Officer.

since March 13, 2015. Ms. Sheehan is also Vice President and Chief Compliance Officer at Princeton Investment Advisors

and Princeton Advisory Group. As the firm’s Chief Compliance Officer, she heads the compliance and legal function across

the firm’s hedge fund, structured product and credit business. Ms. Sheehan’s responsibilities also include oversight

of the Operations department. Prior to joining Princeton Investment Advisors in August 2003, Ms. Sheehan was a senior associate

at Penn Capital Management, an investment advisory firm that managed CBOs and high yield bonds. With over twenty years’ experience

in the investment industry, Ms. Sheehan holds the Investment Adviser Certified Compliance Professional designation and has worked

within the back office, mid and front office as well as compliance and client service departments.

Pursuant to, and as a requirement under, the Settlement Agreement, Mr. Cannella has agreed to resign from all positions he holds with the Company and its portfolio companies, effective as of the day after the Annual Meeting. However, the Board of Director’s intends to vote to re-elect Mr. Cannella as the Chief Financial Officer of the Company at a board meeting following the Annual Meeting.

Board of Directors and Its Leadership Structure

Our business and affairs are managed under the direction of our Board. The Board consists of six directors, four of whom are not “interested persons” of the Company, or its affiliates as defined in Section 2(a)(19) of the 1940 Act and NASDAQ Rules. We refer to these individuals as our “independent directors.” The Board elects our officers, who serve at the discretion of the Board. The responsibilities of the Board include quarterly valuation of our assets, corporate governance activities, oversight of our financing arrangements and oversight of our investment activities.

18